Key Takeaways:

- Stocks delivered strong returns—for the third year in a row, even with plenty of volatility along the way.

- International markets outperformed the U.S., reminding investors why global diversification matters.

- The Fed cut rates while inflation concerns lingered—yet markets still advanced.

- Staying invested mattered more than headlines; investors who “stayed in their seats” were rewarded.

The Big Picture

If 2025 taught investors anything, it’s this: discipline still works.

Despite volatility, headlines, and plenty of reasons to second-guess long-term plans, investors who stayed invested were well rewarded.

Markets climbed higher, diversification mattered, and patience once again proved more powerful than prediction.

U.S. Stocks: Strong Results, Uneven Ride

U.S. stocks finished the year up nearly 18%, closing close to record highs. But it wasn’t a straight line.

Markets surged early, stumbled in the spring, rallied again in the fall, and cooled toward year-end. Along the way, investors navigated:

- Shifting interest-rate expectations

- Trade and tariff uncertainty

- AI enthusiasm—and skepticism

- A prolonged government shutdown

Technology remained influential, and AI-related companies continued to make headlines. But the takeaway isn’t that investors needed to “pick the right stock.”

Broad, diversified portfolios participated without having to chase yesterday’s winners.

Interest Rates: Lower, but Not Simple

The Federal Reserve cut short-term interest rates multiple times in 2025, citing concerns about the labor market—even as inflation remained sticky.

For investors, the important lesson wasn’t the timing of each rate move, but this:

Markets don’t move in lockstep with Fed decisions.

Longer-term rates moved independently, and bond markets posted gains overall. Investors who stayed diversified across stocks and bonds

were rewarded for patience.

The Real Surprise: Looking Beyond the U.S.

One of the most important—and often overlooked—stories of 2025 was international diversification.

- Developed international stocks significantly outpaced U.S. stocks

- Emerging markets also delivered strong results

- Global diversification proved its value after years of U.S. dominance

This is a reminder that market leadership rotates. The best-performing region is rarely the same year after year—which is precisely why diversification matters.

Volatility Felt Worse Than It Looked

There were periods in 2025 that felt unusually turbulent—especially for investors tracking daily market moves.

But zoom out just a bit, and much of that turbulence fades.

This gap between how markets feel and how markets behave over time is where many investors get into trouble.

Emotional decisions during short-term volatility can do more damage than the volatility itself.

The Long View Still Wins

With nearly 100 years of market history behind us, one truth remains consistent:

Long-term investors who stay the course have historically been rewarded.

Markets have endured wars, recessions, inflation spikes, political crises, and countless “once-in-a-lifetime” events—yet patient investors have seen wealth compound over time.

2025 was simply the latest example.

The BFR Takeaway

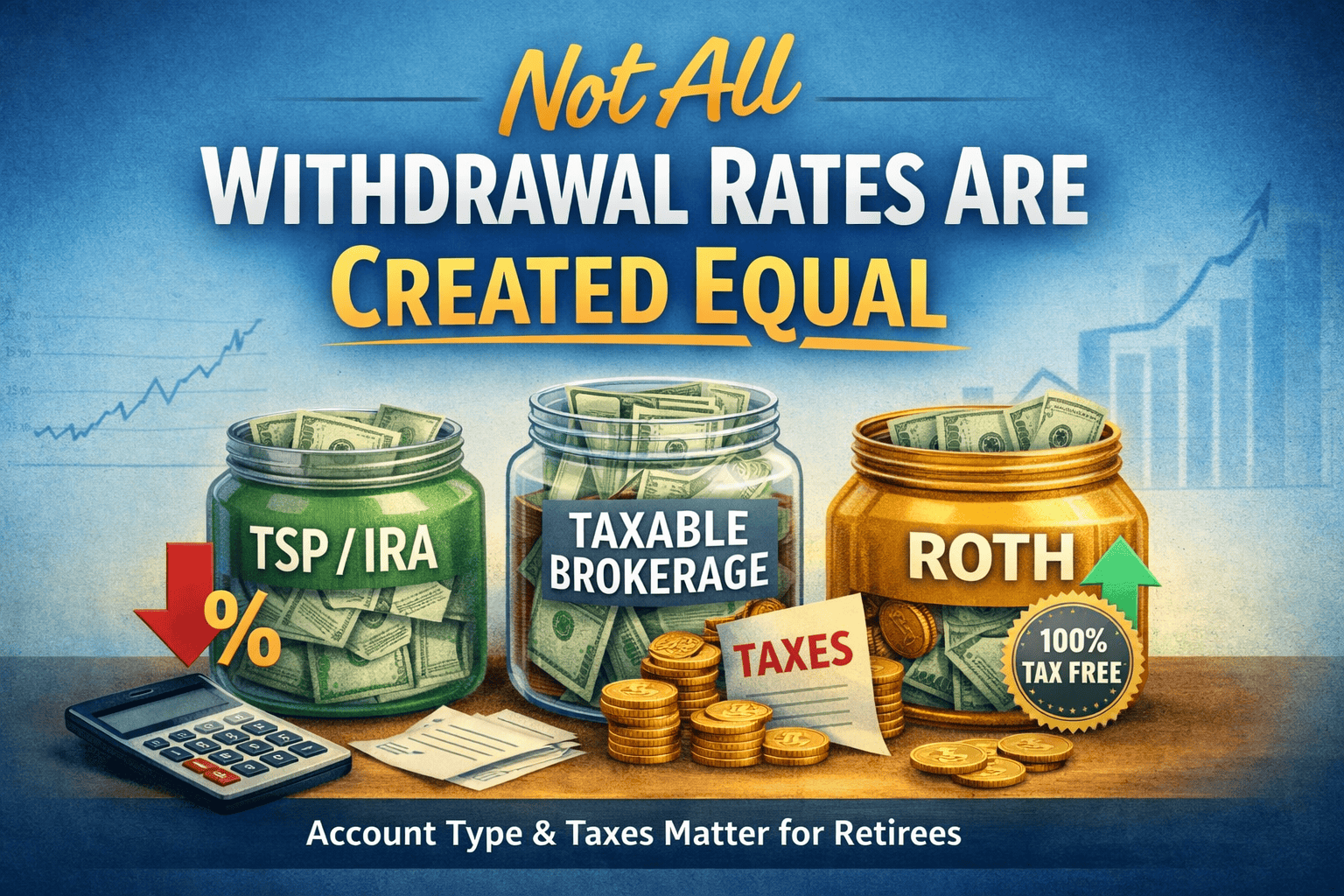

For federal employees and retirees, the lesson isn’t to chase performance or outguess markets. It’s to:

- Build a diversified, goal-aligned portfolio

- Match investments to time horizon and income needs

- Tune out noise—and tune into discipline

- Make changes deliberately, not emotionally

Those who stayed in their seats in 2025 weren’t just rewarded with returns—they reinforced a mindset that supports long-term retirement success.

Better Planning. Better Investing. Better Retirement.

We’ll walk through your situation, answer your questions, and help you understand how evidence-based investing can support a better federal retirement—on your terms.

Disclosure:All written content on the site is for information and educational purposes only and is not intended as personalized investment, tax, or legal advice.

Investing involves risk, including possible loss of principal. Diversification does not ensure a profit or protect against loss in declining markets.

Past performance is not a guarantee of future results.

Leave a Comment