Why Informed Decisions Matter in Your Federal Retirement

At Better Federal Retirement, one of our core responsibilities is simple:

we educate you so that you can make informed decisions.

No one—not me, not any advisor, not any salesperson—knows your best interests better than you do.

The only thing you’ve ever lacked is the information needed to act on them confidently.

That’s why our work together is a process. Not a transaction. Not a one-and-done

“analysis.” A process of growing clarity, layered understanding, and steadily increasing financial

literacy—without ever requiring you to become a financial professional.

A Real Story About Real Learning

One of my favorite client moments happened during her fourth or fifth annual review.

By this point she had grown tremendously— in her understanding of federal benefits, TSP structure, distribution

rules, taxes, Roth strategy, and more. In other words, she wasn’t a beginner anymore. She was sharper and more

experienced.

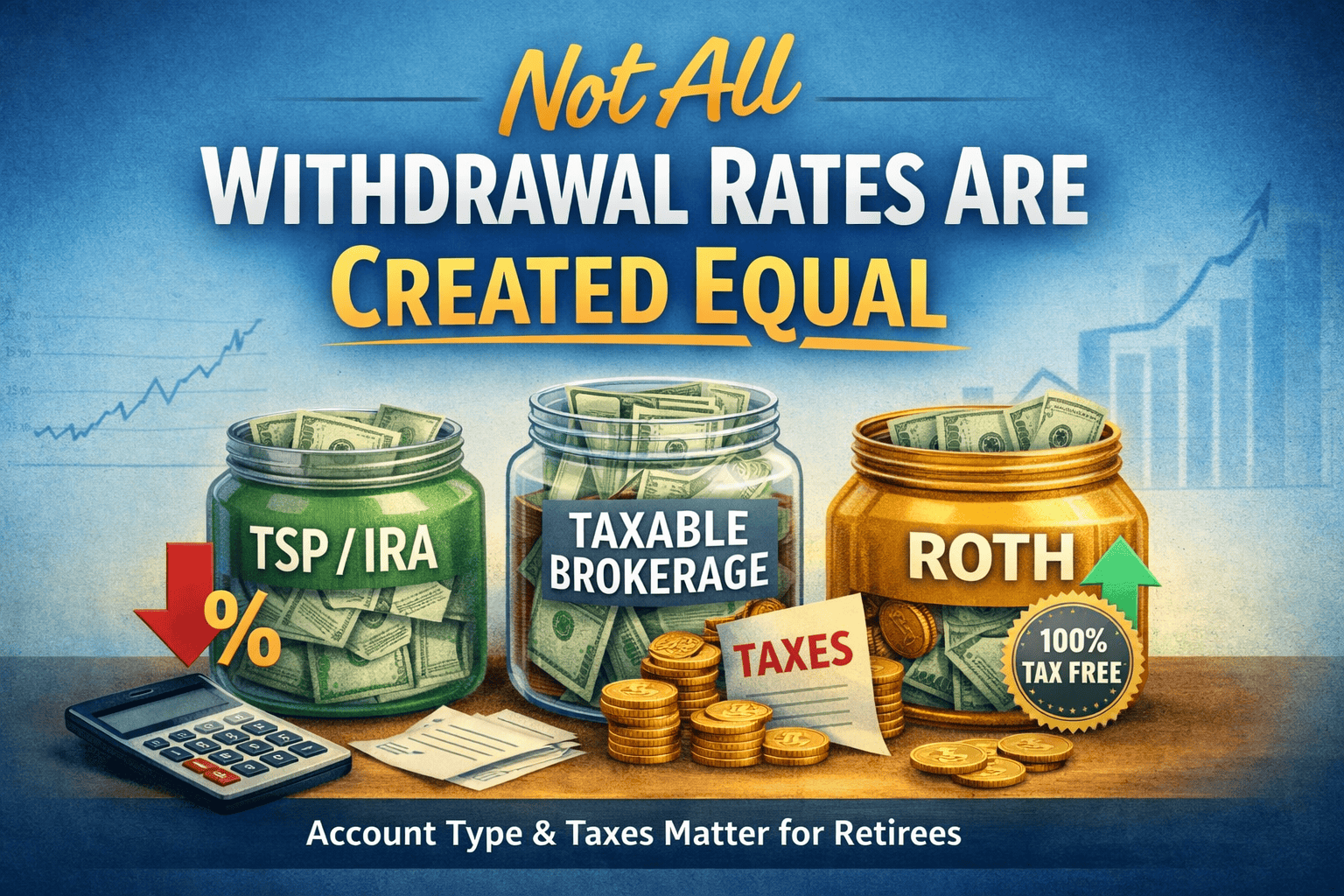

That day, we were reviewing a series of Roth conversions we’d planned—conversions we had

already modeled and confirmed would add significant lifetime value to her portfolio. It was one of those

exciting meetings where the math, the planning, and the long-term strategy all came together.

But the moment also required some advanced knowledge, about:

- Tax brackets and marginal rate management

- The time value of money

- Inflation and purchasing power

- Net present value

- Long-term withdrawal sequencing

Serious topics. Important topics. The kinds of things you need to understand at least at a high level to

make an informed decision.

As we worked through the numbers, she was clearly energized—but I also caught that familiar

“deer-in-the-headlights” look starting to creep in. Her eyes were glazing, not because she wasn’t capable,

but because she was absorbing a lot at once.

I paused and asked her:

“How are you doing—getting it? Feeling overwhelmed? Confused?”

She smiled and said something I will never forget:

“Oh, I’m still confused… but I’m confused at a much higher level!”

The Heart of Good Planning

Her line captured something essential about financial planning:

You don’t need to understand everything.

You don’t need to be a tax expert or an investment strategist.

You don’t need complete clarity on every variable, model, or projection.

What you do need is enough education and guidance to make

informed decisions.

And sometimes that means being comfortable with “higher-level confusion”—because as your knowledge grows,

the decisions get more meaningful, the strategies more nuanced, and the opportunities more valuable.

The True Path From Ignorance to Wisdom

Working with a fiduciary—truly working together over time—means:

- You learn what matters and what doesn’t.

- You develop clarity around your federal benefits and retirement options.

- You understand the “why” behind each recommendation.

- You become aware of what you don’t know.

- You gain the ability to make decisions with confidence, not guesswork.

There is always more knowledge to be gained. There is always some level of uncertainty. But when you know

what you don’t know—and when you have expert guidance—your decisions become dramatically better.

That is the path to an informed decision. And that is why our clients retire with more

confidence, more clarity, and often, more wealth.

Ready to Make More Informed Decisions About Your Federal Retirement?

If you have built meaningful savings in the TSP and other accounts and want a clearer, more confident path

into and through retirement, we invite you to explore whether Better Federal Retirement is the right fit

for you.

Click below to schedule a no-cost, no-obligation conversation where we’ll start educating you on the

key decisions ahead—so you can move from uncertainty toward truly informed decisions.

Better Planning. Better Investing. Better Retirement.

If you’ve built significant wealth inside the TSP and wonder whether keeping it is still the best fit—or if it’s simply the most familiar—let’s explore that together.

Educational information only. Not investment, tax, or legal advice. Advisory services offered by Better Federal Retirement, a fiduciary and fee-only firm. All investing involves risk, including possible loss of principal.

Leave a Comment