The most important question in retirement planning rarely gets asked first.

Financial advisors everywhere love to ask:

“So… how much would you like to spend in retirement?”

That sounds like a reasonable place to start. Yet more often than not, I watch retirees blink, pause, and reply:

“I don’t know. As much as I can!”

How much can you spend in retirement? That is the question that matters. And it deserves a better answer than the industry usually gives.

Budgets Are Useful… For Some People

Sure, some folks love their detailed budgets: color-coded spreadsheets, envelopes, the whole thing. If that’s you, wonderful. You already know what spending makes your life feel comfortable.

Most successful federal employees, however, are not budgeting their life down to the penny. They simply want…

- The ability to do what they want

- Without fear they’ll run out

- While hopefully leaving something meaningful behind

Not a lavish life. Just a life fully lived.

So the real mission of retirement planning becomes clear:

Determine your sustainable spending capacity.

Not what you wish you could spend.

Not what someone tries to sell you.

The number you can confidently live on.

Why Answers Differ Depending On Who You Ask

When retirees ask a commissioned annuity salesperson how much they can spend, the answer tends to be simple and guaranteed. Something like:

“You can get $4,000/month for life if you roll your TSP into this annuity.”

Predictable? Yes.

Flexible? Not really.

Optimal? Rarely.

Because that “guarantee” comes at a cost:

- Lower lifetime spending potential

- Loss of access to your own cash

- Reduced ability to leave a legacy

- No upside if markets perform well

In other words:

You trade possibility for simplicity.

Enter: Retirement Risk Tolerance (Not What You Think)

Most people hear “risk tolerance” and picture stock charts bouncing around. Up means “yay!”, down means “oh no!”

Retirement changes the definition.

Once you stop working, risk tolerance is really about income flexibility.

- Can your income go down occasionally if markets have a rough year?

If yes, even just a little… your potential income can be significantly higher.

Here’s a simplified comparison:

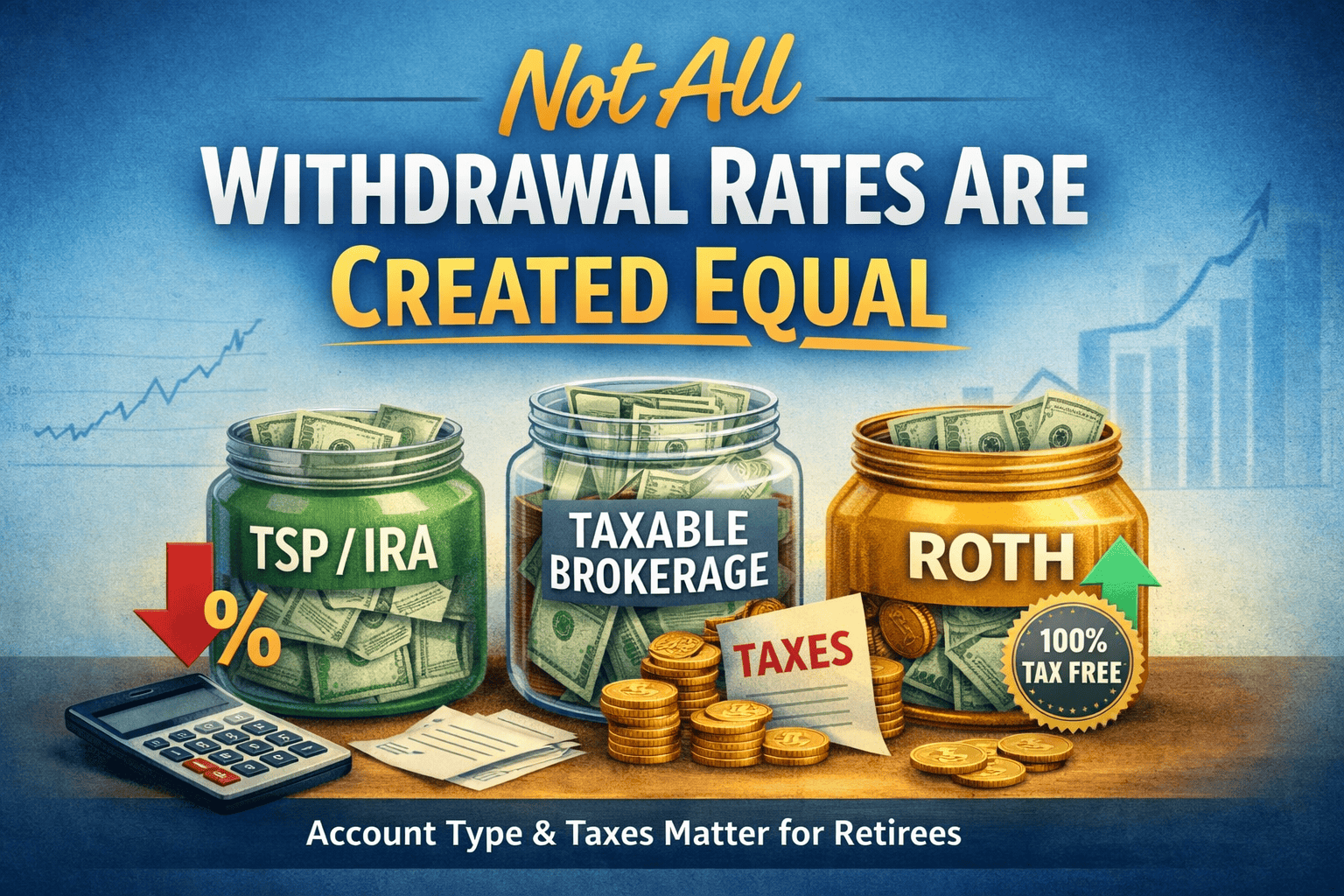

| Strategy | Typical Monthly Income | Flexibility | Legacy Value | Upside Potential |

|---|---|---|---|---|

| Guaranteed Income Annuity | $4,000 | None | Usually Low | None |

| Well-managed Portfolio (SWIP) | $5,000–$6,000 | Lots | Higher | Yes! |

SWIP = Systematic Withdrawal Income Plan. A fancy way of saying: your investments stay invested, growing and providing income while being actively managed.

Even a small willingness to adjust spending in tough years unlocks thousands more income annually.

More tacos, more grandkid adventures, more living.

The Income Flooring vs. Income Freedom Spectrum

One size fits nobody in retirement.

Many retirees thrive with a combination:

Income Flooring

A baseline of guaranteed income (like FERS pension + Social Security)

= Stability, comfort, bills paid

Then maybe a measured amount of annuity if needed

Income Freedom

A professionally engineered withdrawal plan from your investments

= Flexibility, upside, and stronger legacy potential

The wealthier you are, the more the balance usually shifts toward the flexible side.

If you have $500k+ in investable assets, the income advantage from a SWIP vs. strictly annuitizing grows dramatically.

Why lock up your life savings if you don’t have to?

Let’s Get Personal… Because Your Life Is

There’s no canned formula that prints the right spending number.

We answer the real question only by knowing you:

- Your lifestyle

- Your fears

- Your values

- Your desire to help kids or grandkids

- Your willingness to let spending adjust slightly in bad markets

- Your health and longevity expectations

- Your pensions and federal benefits

- Your TSP and other investments

Two families with the exact same dollar amount can have very different sustainable incomes based on these details.

The Bottom Line

You didn’t work a lifetime to live a watered-down version of retirement.

You deserve advice that says:

Here’s what you can confidently enjoy… and here’s how we protect it.

- Not generic rules of thumb

- Not “one-size-fits-all” product pitches

- Not guarantees that cost you too much of your own future

Retirement doesn’t need to be a guessing game, or an exercise in fear.

It can be a well-planned, joyful harvest season.

If you’re a federal employee or retiree with more than $500k in your TSP and other savings, let’s run the numbers together. We’ll answer your question with clarity and confidence:

How much can you spend in retirement?

The answer is waiting for you.

Better Planning. Better Investing. Better Retirement.

If you’ve built significant wealth inside the TSP and want to make it last without compromise—let’s explore that together.

Educational information only. Not investment, tax, or legal advice. Advisory services offered by Better Federal Retirement, a fiduciary and fee-only firm. All investing involves risk, including possible loss of principal.