Many federal employees tell me the same story: as they approach retirement, their inbox fills with messages urging them to roll over their TSP. These solicitations tend to fall into two groups:

- Companies selling annuities

- Companies selling Gold IRAs or other precious metals

Each group often promotes a single product as though it should be the foundation of your entire retirement strategy. As a Certified Financial Fiduciary® and Federal Retirement Consultant (FRC), I want to provide clarity on when these tools can be appropriate—and when they are not.

Annuities and Gold Each Have a Place. Just Not Center Stage.

Annuities can provide guaranteed lifetime income and address longevity risk. Gold and other precious metals can hedge inflation and improve diversification through low correlation to traditional markets.

At Better Federal Retirement, these can be included thoughtfully:

- Modest, risk-managed allocations to precious metals inside our Unified Managed Accounts (UMAs)

- Select annuity recommendations when lifetime income needs clearly benefit from them

In both cases, the important considerations are:

- What purpose is the investment serving?

- How much allocation is appropriate?

- How does it support your broader retirement plan?

No fiduciary acting in a client’s best interest would recommend rolling over an entire TSP into a single product.

Learn more about our UMA approach here.

Be Cautious With “Free Retirement Analysis” Offers

Many annuity sales teams begin by offering what appears to be a free Federal Retirement Review. Very quickly, the conversation starts steering toward one conclusion: purchase the annuity they sell.

Meanwhile, gold-focused firms often rely on dramatic headlines or fear-based messaging. The theme tends to be: “Market collapse is near—move everything into gold now.”

Neither approach reflects a balanced retirement strategy.

Why These Pitches Deserve a Second Look

Many annuities and Gold IRAs pay high commissions to the salesperson. That structure can create a serious conflict of interest if it influences the recommendation you receive.

A fiduciary relationship requires:

- Disclosure of conflicts

- Advice tailored to your full retirement picture

- A commitment to put your goals first

Your plan should be driven by evidence and expertise, not a commission schedule.

The Right Tools, Used the Right Way

When used appropriately inside a comprehensive plan, real-asset exposure and income solutions can strengthen retirement outcomes.

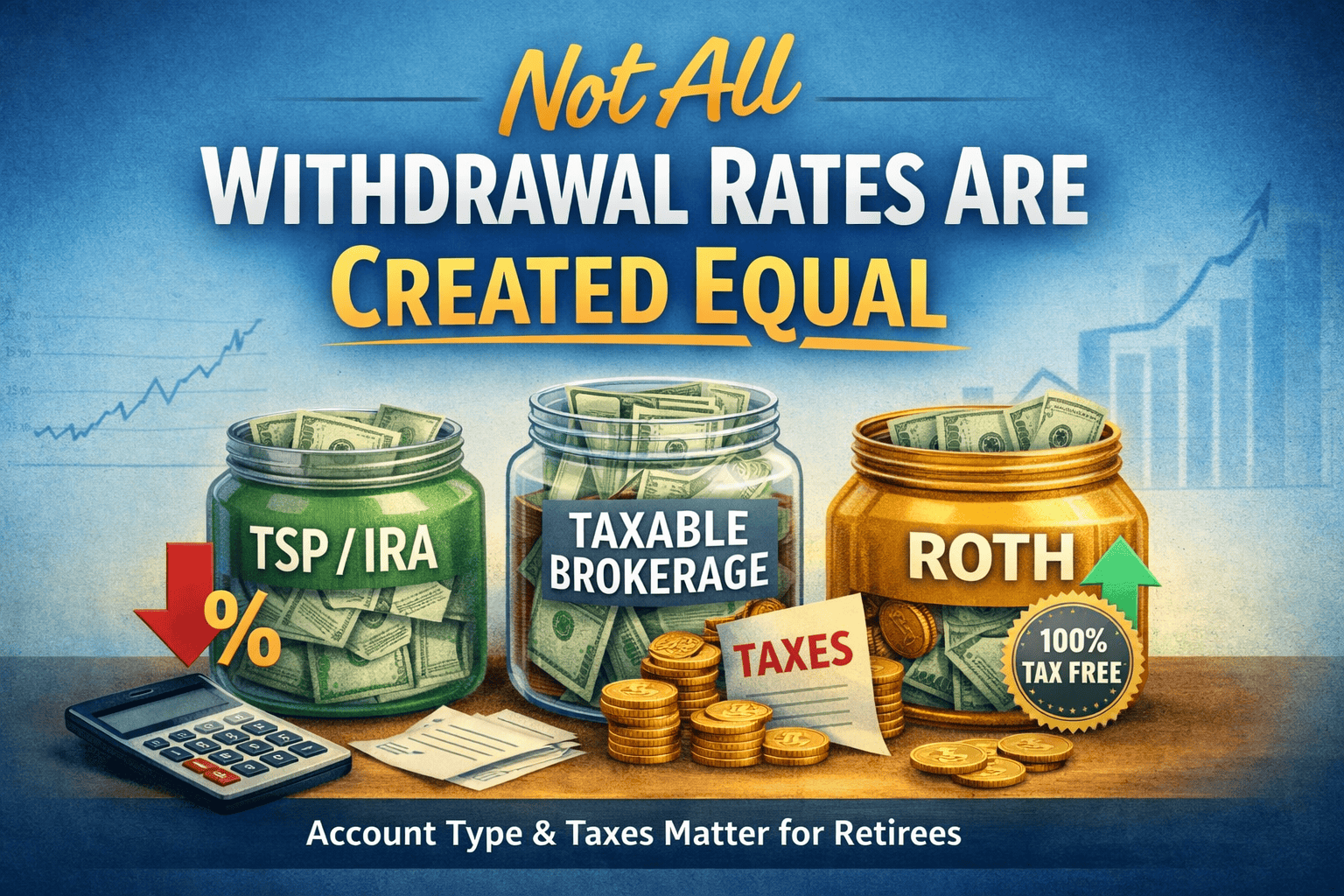

Our UMAs help federal employees coordinate:

- Income timing with FERS, FEHB, and Social Security

- Growth investments with risk-managed alternatives

- Liquidity needs with long-term protection

The result is a truly diversified strategy based on you, not a single product.

If You’re Considering an Annuity or Gold IRA

A second opinion is an easy way to ensure you’re being served rather than sold.

If you have over $250,000 in investable assets (including your TSP), and you are being pitched a Gold IRA or annuity, I invite you to reach out. I specialize in helping federal employees navigate retirement with clarity and confidence.

Better Planning. Better Investing. Better Retirement.

All written content on this site is for educational & informational purposes only. Not investment, tax, or legal advice. Opinions expressed hearin are solely those of Nigel Valdez / Better Federal Retirement. All investing involves risk, including possible loss of principal.

Your retirement deserves a strategy—not a sales tactic.