Understanding the Three Fiduciary Duties: What They Mean for Federal Employees

If you’re a federal employee preparing for retirement, you’ve probably seen the term “fiduciary” used in many places. It’s a word that carries weight, but it’s not always clear what it means—or what it requires from an advisor.

In reality, the fiduciary standard is built on three core duties:

-

The Duty of Loyalty

-

The Duty of Good Faith

-

The Duty of Due Care

These duties are the foundation of fiduciary practice. They aren’t about fancy strategies or complicated financial jargon—they’re about how an advisor behaves, how decisions are made, and how your interests are protected.

This article simply explains these three duties and what they mean for you as a federal employee planning for retirement.

1. The Duty of Loyalty

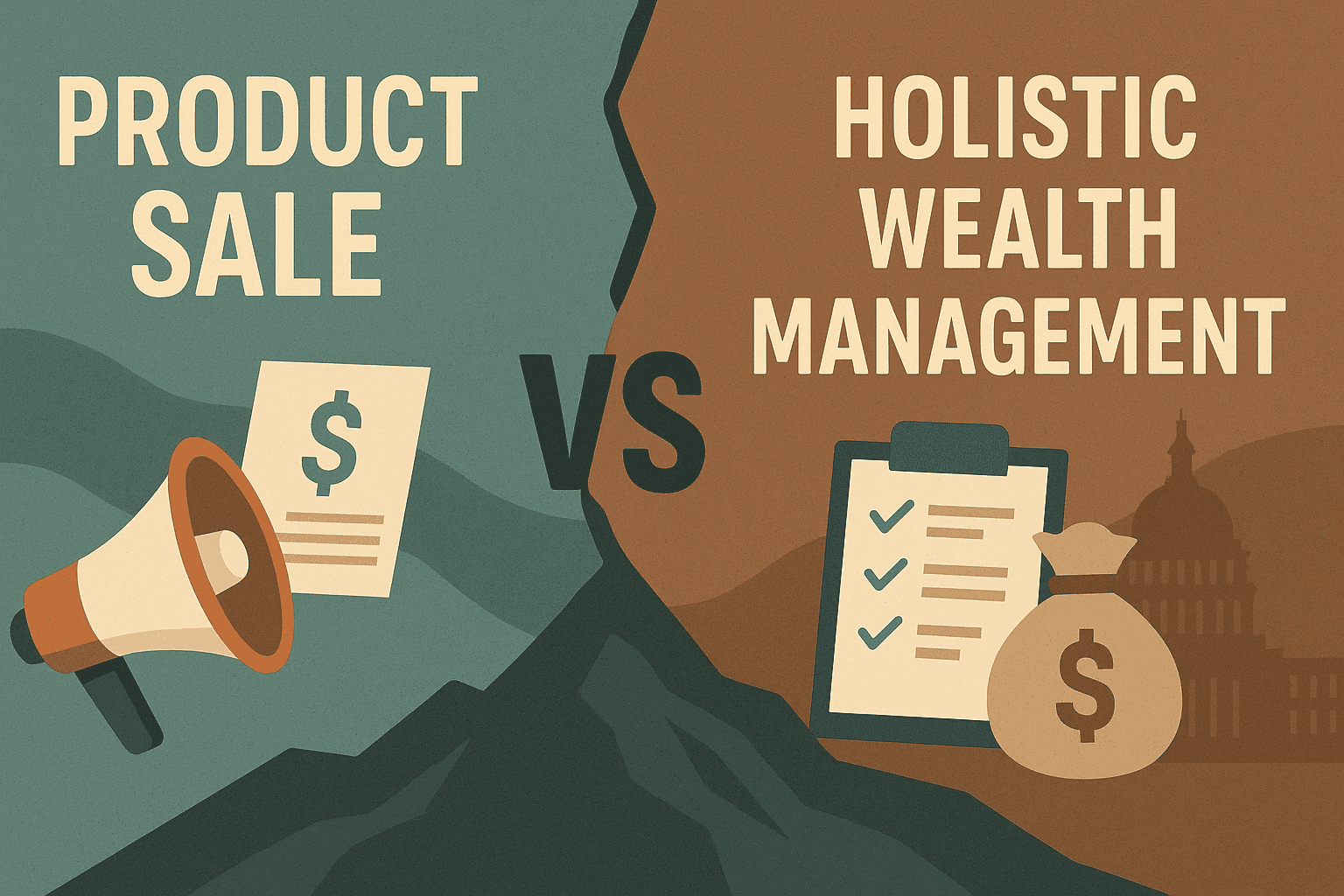

The Duty of Loyalty means the advisor must put your interests first—ahead of their own compensation, ahead of their firm, and ahead of any product or sales agenda.

In practical terms, it means:

- Recommendations must be made for your benefit.

- Conflicts of interest must be avoided or clearly disclosed.

- The advisor cannot prioritize commissions or incentives over your needs.

For federal employees who have often encountered product-driven sales pitches—“free benefits reviews,” annuity promotions, or TSP rollover pressure—this duty is especially important.

Better Planning. Better Investing. Better Retirement.

Have you built significant wealth inside the TSP and want to experience Fiduciary Loyalty?

2. The Duty of Good Faith

The Duty of Good Faith covers the advisor’s honesty, transparency, and fairness.

It requires:

- Clear communication

- Reasonable explanations

- Straightforward, understandable recommendations

- A professional relationship built on trust

Good faith does not require you to understand every technical detail. Many federal employees prefer a collaborative relationship in which they set the goals and the advisor handles the calculations, modeling, and planning. That is perfectly appropriate.

Your role is to express your values, priorities, and concerns. The advisor’s role—under good faith—is to explain options plainly and help you make decisions that feel right for you.

3. The Duty of Due Care

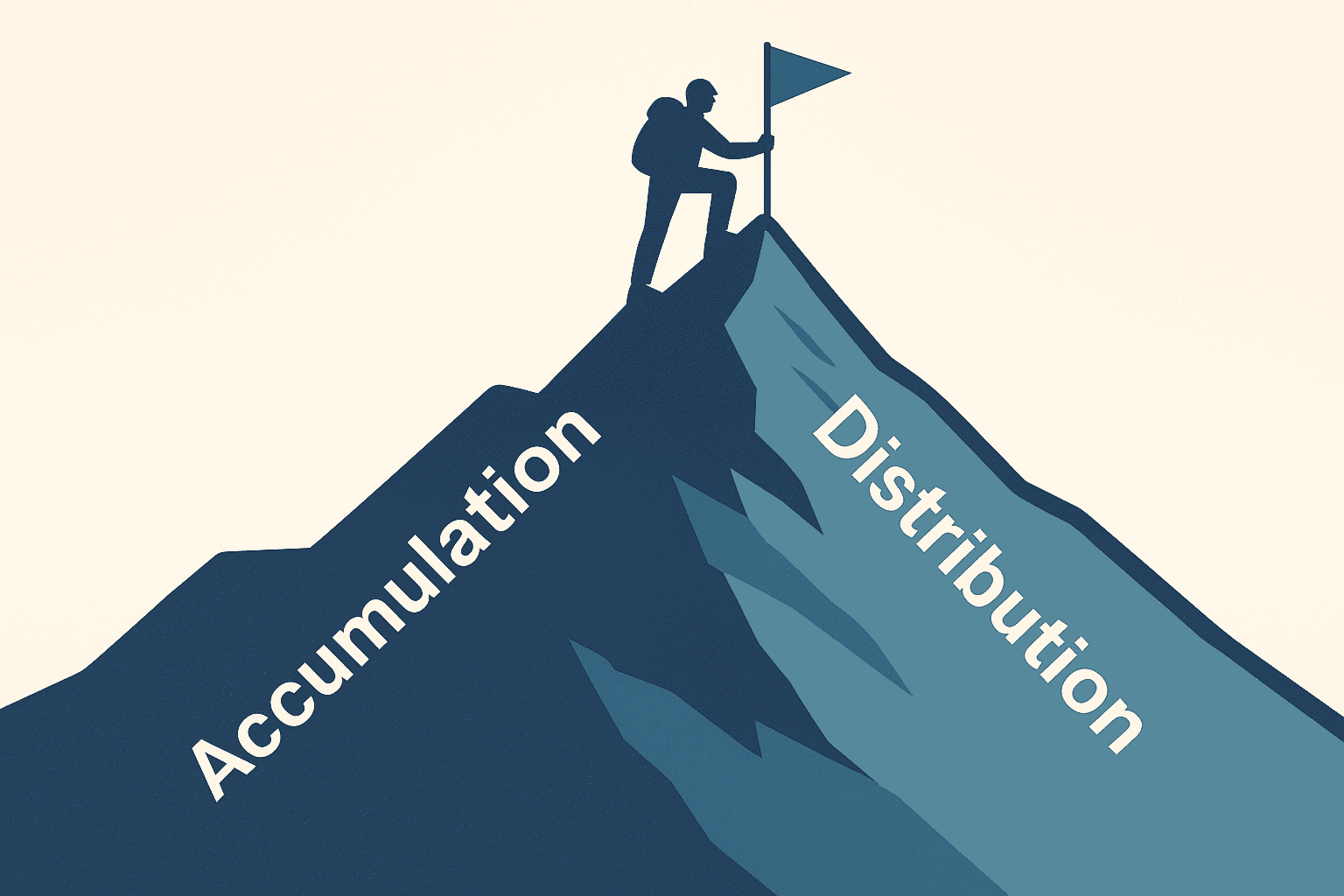

The Duty of Due Care focuses on competence and diligence.

This is not about expecting you to master financial concepts—it’s about expecting your advisor to do the work necessary to guide you responsibly.

Due Care means the advisor must:

- Take the time to understand your full financial picture

- Use sound methods, modeling, and analysis

- Stay current with rules affecting federal benefits and retirement

- Coordinate decisions across investments, taxes, income planning, and benefits

- Provide recommendations that reflect the complexity of your situation—even if you prefer to delegate the technical pieces

Many federal employees want clarity, not complexity. Due Care ensures that your advisor handles the complexity for you and explains the reasoning whenever you want or need it.

In other words, you do not need to understand how every moving part fits together—your advisor does. You simply need confidence that they are applying thoughtful, well-informed judgment on your behalf.

Why These Duties Matter

Federal retirement decisions involve interconnected systems—FERS, TSP, FEHB, Social Security, survivor benefits, taxes, and more. Because of that, you benefit from working with an advisor who:

- Listens carefully,

- Communicates plainly,

- Works holistically, and

- Stays accountable to these three fiduciary duties.

Whether you prefer to be deeply involved in the details or would rather delegate much of the process, the fiduciary standard ensures that the advice you receive is grounded in integrity, professionalism, and care.

A Final Thought

Not every advisor who works with federal employees follows this standard, and understanding the three fiduciary duties can help you evaluate whether an advisor’s approach aligns with what you value.

You don’t need to become an expert; you simply deserve to work with someone who takes these responsibilities seriously and helps you make decisions confidently and comfortably.

Want a Fiduciary Review of Your Federal Retirement Plan?

If you’d like a second opinion on your current plan—or you’re not sure whether the advice you’re getting

truly reflects these fiduciary duties—you’re welcome to schedule a brief, no-cost conversation.

We’ll focus on your goals, your federal benefits, and your questions. No products, no pressure—just a chance

to see whether working with a fiduciary feels like a good fit.

Educational information only. Not investment, tax, or legal advice. Advisory services offered by Better Federal Retirement, a fiduciary and fee-only firm. All investing involves risk, including possible loss of principal.

Leave a Comment