Have you outgrown the TSP? Consider a rollover if you have more than $400,000.

For federal employees, the Thrift Savings Plan is a powerful launchpad: low costs, broad exposure, and effortless payroll contributions. All good things. However, once your wealth surpasses roughly $400,000, the TSP shifts from “perfect fit” into “still good… but not good enough.” This article makes the case for the high-net-worth TSP rollover.

Many high-balance federal employees never take advantage of their expanded financial capacity. Not because they lack motivation, but because their options are often limited by platforms and firms that were built for the masses, not for the complexities that come with real wealth. Your financial advice should evolve as your wealth does.

We have built our approach around core structural advantages. These aren’t gimmicks. They are the ingredients that consistently elevate outcomes for clients who want more than “good enough.”

Our Edge for High-Net-Worth Federal Investors

Insight

No single firm, strategy, or index deserves blind loyalty. We seek wisdom from across Wall Street—opinions, forecasts, and research from multiple sources—so decisions benefit from a wider field of informed perspectives.

Access

Some of the most powerful opportunities aren’t available on public platforms or inside the TSP. They require relationships, reputation, and experience. We curate access to specialized managers, private strategies, and solutions that can be difficult to find or enter.

Technology

Modern wealth requires modern systems. We integrate advanced research tools and platforms to support precision portfolio design, risk management, and tax-aware planning.

People

Wealthy investors deserve guidance from professionals who have spent their careers serving ultra-high-net-worth and institutional clients. Theory has value; experience is transformative.

Process

More wealth creates more moving parts. Our process coordinates each piece so your strategy stays aligned, tax-aware, risk-tested, and ready to adapt. From onboarding to implementation, process reduces detours and speeds course correction.

The High-Net-Worth TSP Rollover Opportunity Set

Once you’ve crossed that $400K threshold, with a TSP rollover your toolkit can finally include:

- Active, risk-managed strategies and institutional-quality separate accounts (SMAs & UMAs)

- Alternatives and real assets with low or differentiated correlation

- Private credit, structured notes, and long/short solutions

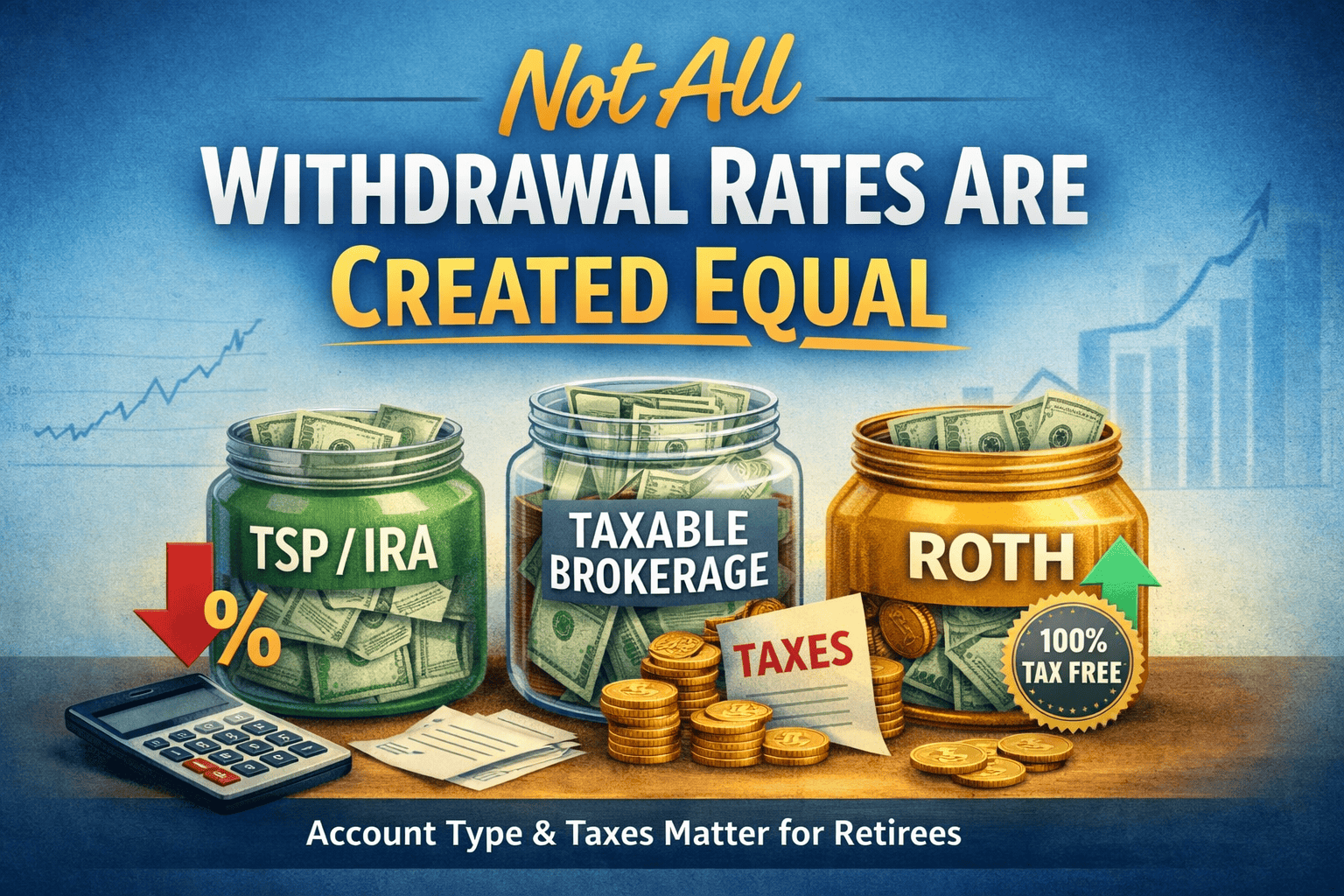

- Tax-efficient withdrawal engineering and bespoke cash-flow planning

- Values-aligned (ESG/SRI) customization without sacrificing rigor

The TSP is a terrific foundation. It was never designed to be your entire house.

We Are Customers of Wall Street, Not Employees

Traditional firms often lead with their own products. Our open-architecture approach flips the script: we sit on your side of the table. Together we are customers of the best that Wall Street has to offer.

- Access to best-in-class traditional managers

- Nimble innovators and unique strategies (including selective, hard-to-access offerings)

- Carefully curated solutions chosen for your specific goals and constraints

Our role is to solve your goals with the right tools, not to fit you into a single-firm menu. We monitor, adjust, and course-correct with you so your strategy moves at the speed of your life.

If Your Wealth Has Evolved, Your Strategy Should Too

If you have more than $400,000 of investable assets (including the TSP), you’ve likely outgrown a one-size-fits-all solution. Your success has earned you options. Let’s explore them.

Ready for a higher-caliber plan?

Schedule a 20-minute conversation to see whether our approach is the right fit for your situation. Serious inquiries only; we keep capacity intentionally limited for white-glove service.

Better Planning. Better Investing. Better Retirement.

If you’ve built significant wealth inside the TSP and wonder whether keeping it is still the best fit—or if it’s simply the most familiar—let’s explore that together.

Educational information only. Not investment, tax, or legal advice. Advisory services offered by Better Federal Retirement, a fiduciary and fee-only firm. All investing involves risk, including possible loss of principal.