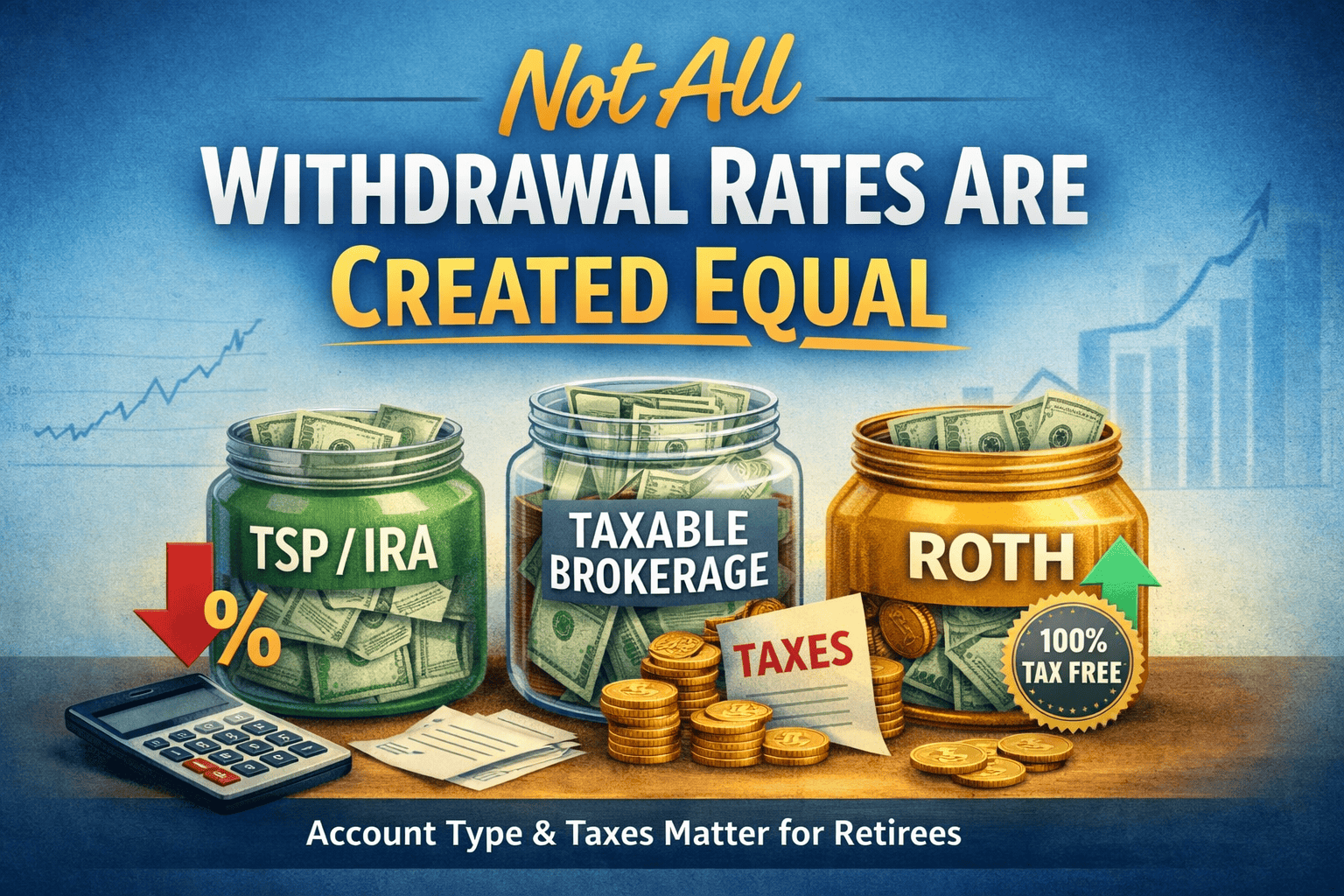

Safe Withdrawal Rates & Taxes for Federal Retirees

At Better Federal Retirement, we frequently work with federal retirees who are using—or planning to use—a Systematic Withdrawal Income Plan (SWIP) to create dependable retirement income.

Many have heard of the 4% rule and reasonably ask:

“If I’m withdrawing $40,000 a year, does it really matter whether that money comes from my TSP, IRA, Roth, or brokerage account?”

The answer is yes—it matters significantly, and the reason has everything to do with tax drag.

The Hidden Headwind: Tax Drag

Tax drag refers to the ongoing reduction in portfolio growth caused by taxes that must be paid while assets remain invested.

This is most visible in taxable brokerage accounts, which are subject to:

- Taxes on dividends

- Taxes on interest income

- Taxes on realized capital gains

Even when these distributions are reinvested, taxes reduce the amount left to compound. Over a multi-decade retirement, that drag can materially affect how long your money lasts.

Why This Matters for Federal Retirees Using SWIPs

A safe withdrawal rate is not just about how much you spend—it’s about how much remains invested and growing after spending and taxes.

When ongoing taxes reduce growth:

- Compounding slows

- Sequence-of-returns risk increases

- The sustainable spending rate declines

This is why two retirees withdrawing the same dollar amount can experience very different long-term outcomes—based solely on which accounts they are drawing from.

Different Accounts, Different Sustainable Withdrawal Rates

Retirement researcher Dr. Wade Pfau has quantified this effect by examining after-tax sustainable spending rates across different account types. His research shows:

- Roth accounts: ~4.00%

- Taxable brokerage accounts: ~3.74%

- Traditional IRAs / tax-deferred accounts (including the TSP): ~3.43%

These figures reflect after-tax, inflation-adjusted spending rates that have historically been sustainable—not just pre-tax withdrawal percentages.

Why Roth Dollars Are Often the Most Flexible in Retirement

Roth accounts offer two powerful advantages:

- No ongoing tax drag while invested

- Tax-free withdrawals

Because every dollar remains fully invested and compounding, Roth assets can often support higher sustainable spending and provide valuable flexibility—especially later in retirement or during volatile markets.

Why Tax-Deferred Accounts Require Careful Coordination

Tax-deferred accounts like the Traditional TSP and IRAs avoid tax drag during accumulation, but:

- Withdrawals are fully taxable

- Required Minimum Distributions (RMDs) can force income at inopportune times

- Taxes can magnify downside risk during market declines

When measured on an after-tax spending basis, these factors reduce the sustainable withdrawal rate.

What This Means for Your Federal Retirement

For federal retirees, the takeaway is clear:

Safe withdrawal rates are account-specific, tax-sensitive, and planning-dependent.

A well-designed Systematic Withdrawal Income Plan doesn’t start with:

- “What percentage should I withdraw?”

It starts with:

- Which account should fund income today?

- Which accounts should be preserved for later years?

- How do taxes affect sustainability over decades—not just this year?

The BFR Approach: Tax-Aware, Evidence-Based Income Planning

At Better Federal Retirement, we design SWIPs that:

- Coordinate TSP, IRA, Roth, and taxable accounts

- Intentionally manage tax brackets

- Reduce lifetime tax drag

- Adapt withdrawals to market conditions and retirement phases

The goal isn’t simply income—it’s durable, flexible, tax-efficient income that supports confidence and control throughout retirement.

Bottom Line

If you’re withdrawing $40,000 per year, where that money comes from may be just as important as how much you withdraw. Understanding tax drag—and planning around it—is essential to building a Better Federal Retirement©.

Better Planning. Better Investing. Better Retirement.

If you’ve built significant wealth, within the TSP or without, and want took keep it in your (and your loved ones’) hands, and not that pesky uncle Sam, then let’s talk.

All written content on this site is for educational & informational purposes only. Not investment, tax, or legal advice. Opinions expressed hearin are solely those of Nigel Valdez / Better Federal Retirement. All investing involves risk, including possible loss of principal.

Leave a Comment