Retirement Planning, Tax Planning

Retiring With a TSP Loan? A Simple Decision Framework to Avoid Costly Mistakes

Better Federal Retirement™ • Planning for affluent federal employees who want more freedom, clarity, and control. Retiring With ...

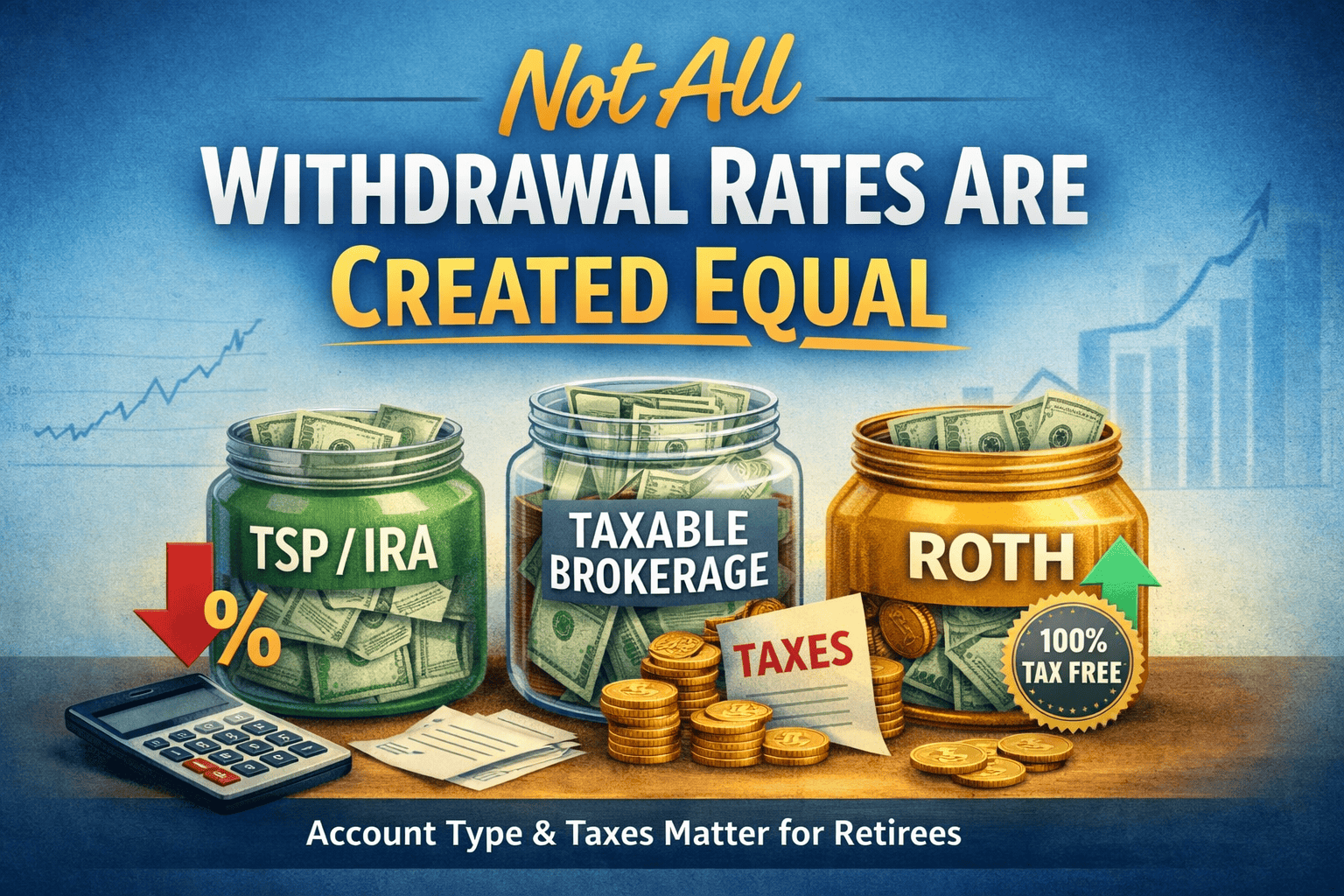

Why Your “Safe” Withdrawal Rate Depends on Taxes

Safe Withdrawal Rates & Taxes for Federal Retirees At Better Federal Retirement, we frequently work with federal retirees ...

2025 Delivered for Those Who Stayed in Their Seats

Markets rewarded discipline. Diversification mattered. Long-term investors were paid for patience. Key Takeaways: Stocks delivered strong returns—for the ...

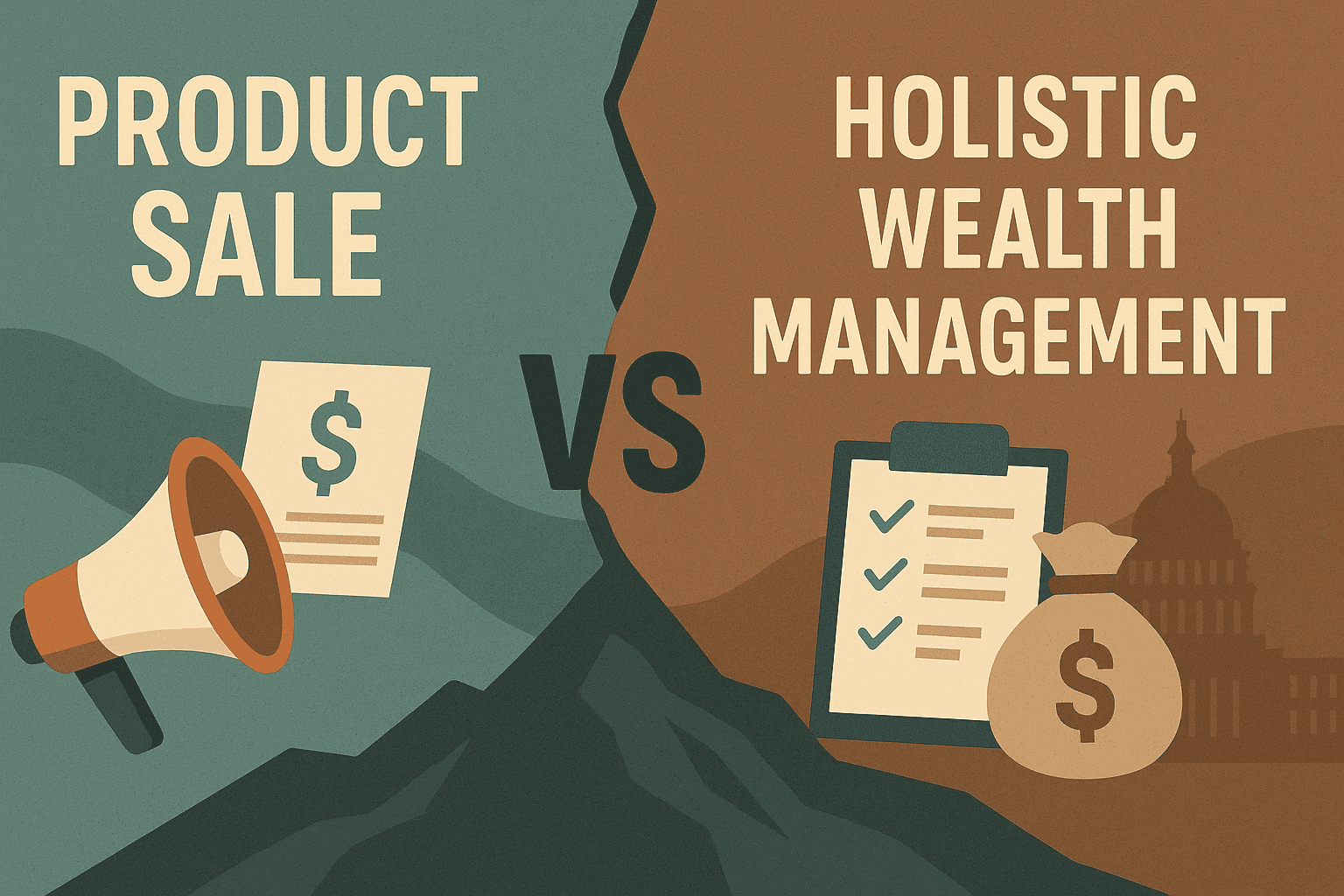

The Reality Behind TSP Roll-Over Pitches Targeting Federal Employees

Many federal employees tell me the same story: as they approach retirement, their inbox fills with messages urging ...

Meet the UMA: A Thrift Upgrade for Federal Employees

For decades, the Thrift Savings Plan has been a workhorse for federal employees. It is low-cost and simple, ...

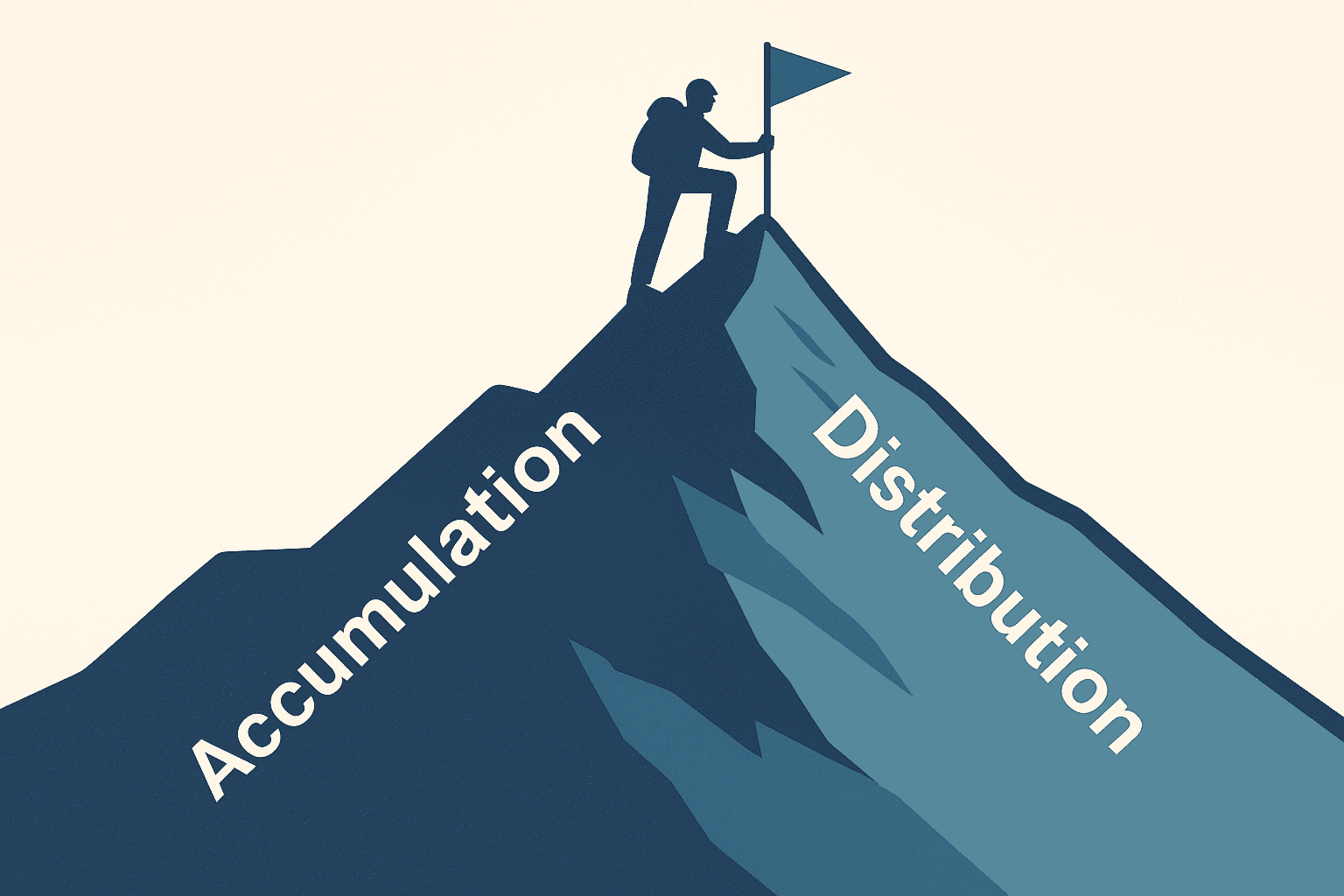

How Much Can You Spend In Retirement?

The most important question in retirement planning rarely gets asked first. Financial advisors everywhere love to ask: “So… ...

Common Investing Mistakes to Avoid in Your Retirement Income Planning

If you’re looking to retire within the next decade, it’s crucial to have a financial plan that’s built ...

Independent — Not Alone: The Power Behind “Better Federal Retirement”

Many federal employees appreciate that I’m an independent fiduciary advisor — it means my loyalty is to my ...

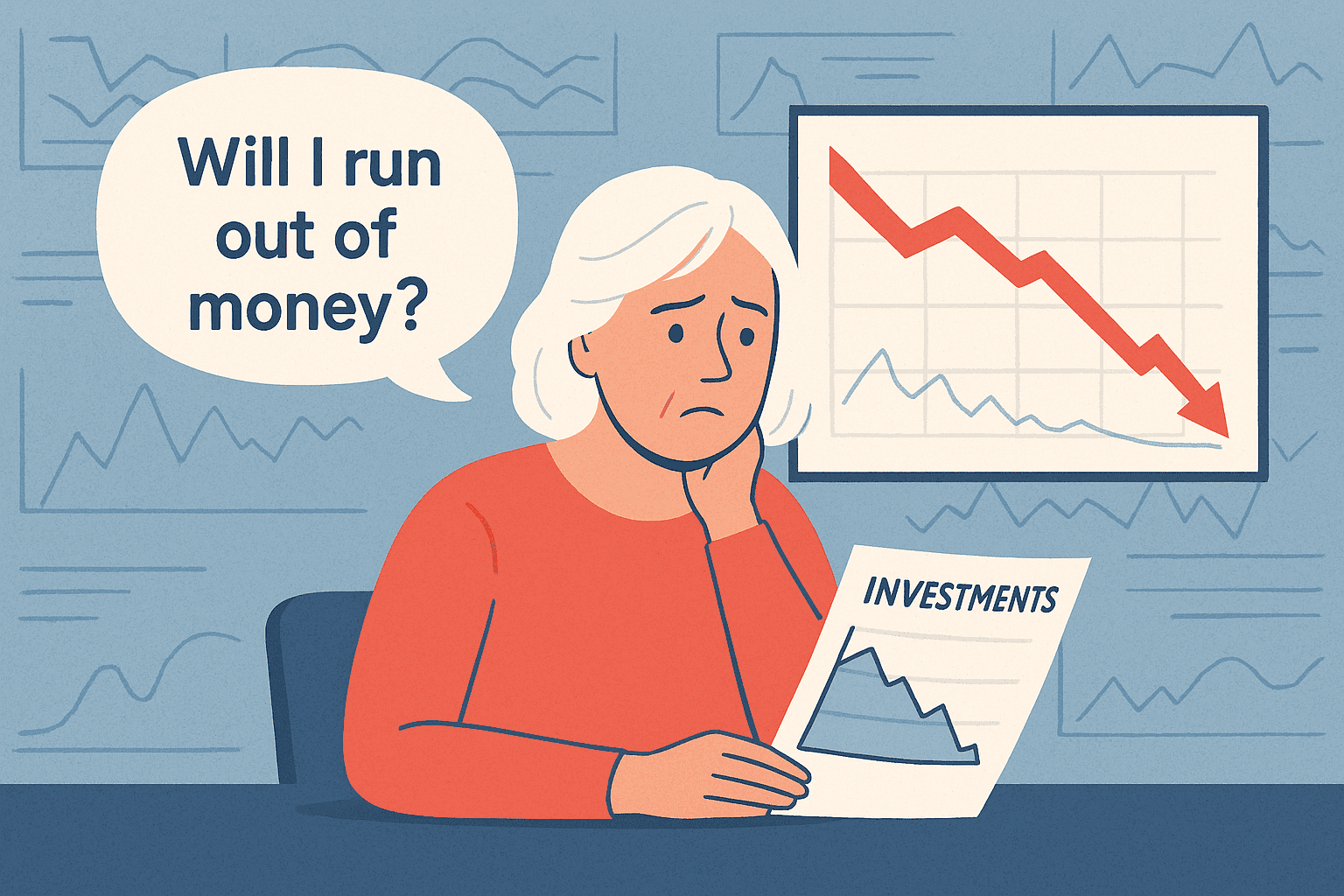

What Retirees Actually Worry About—And a Smarter Way to Plan for It

When most people think about investment risk, they imagine scary headlines and sudden market drops. But if you’re ...

What is A Fiduciary Advisor and Why Does It Matter?

Understanding the Value of a Fiduciary in Your Financial Journey What’s a fiduciary? Is every financial advisor a ...

Is Your Retirement Strategy Right for You?

Retirement planning can be a complex journey, especially if you’re a federal employee retiree or nearing retirement. There’s ...